These 11 important tips will help you easily find your dream home for your family.

Like every other Filipino family, it’s our dream to have our own home.

Before the pandemic, we were renting a condo unit in Makati City because it

was near our office. It was a practical choice that justified the condo

rental cost. However, after a few years, Mommy Khris and I thought it best

to invest in our own house. After all, we’re already spending on monthly

rent and condo dues so we might as well get a housing loan and may the

monthly amortization instead.

The 11 Important Things To Remember When Buying A New House

We wanted a house and lot because we wanted the freedom that it affords, both

for us and the kids. We can have a yard with a garden where the kids can play.

We can also set up our own mini-farm in the backyard.

We were already scouting for houses and lots in several locations but then the

pandemic happened so we had to postpone our plans again for health and safety

reasons. We will probably resume our house hunting project again when things

have begun to ease a little bit.

Buying a new house needs careful planning

Buying a house and lot needs a lot of thought because it involves a lot of

money. It’s a long-term, even lifelong, a decision that leaves no room for

errors. Financially speaking, a simple money mistake can drain your savings

and put you in great debt.

A wrong decision when it comes to the location can leave you feeling

frustrated with your choice. Just the same, the things that you have to

consider are not really complicated matters. They are, in fact, practical but

most of us might overlook them especially if we have other concerns to think

about.

What to remember when buying a new house

When we were looking for our house, we made a list of the most important

things to keep in mind when it comes to buying our dream home. These were

actually helpful because it helped us narrow down our choices.

If it might help you, you might also want to consider the following things:

1. Always think long-term

This is possibly one of the biggest lessons I’ve learned when investing in a

property. Imagine how your life will be in ten years or so and evaluate

whether the house you are eyeing will still be able to help you fulfill your

life and family goals, such as more kids or a home business that you probably

want to set up in the future. In short, don’t just buy a house for your

current life situation.

2. Set a budget

Your house is your long-term investment so you have to set a budget for it.

Consider the size of the house versus the selling price. Generally, properties

located in Metro Manila are priced higher as compared to those in the

provinces. If you’d like your house to be in the National Capital Region, then

you should be ready to shell out a higher amount.

On the other hand, being located in the province such as Laguna, Cavite,

and Bulacan lends lower prices to properties. Aside from the cost, a

provincial location might actually be a wiser choice because of the largely

less chaotic life of provincial living.

3. Consider the location

The location of your house should also dictate your choice. While I did

mention above one advantage of provincial life, it might not work for other

people. Living in the province might prove to be an even more challenging

choice for some individuals especially if their work is demanding. The travel

time might prove to be impractical for them in the long run.

Not only that, you have to consider your house’s proximity to schools, if you

have children, as well as to hospitals and commercial centers. These are

essentials that need to be close by.

4. Security should always be top of mind

Our family’s security is always at the top of our list. As such, we always

look for properties that are in gated subdivisions or are at least in a quiet

and generally peaceful neighborhood.

5. Buy from a trusted developer

Buying a house involves making wise decisions and one of these is to deal with

trusted developers only. It’s a longstanding commitment so you want everything

to be as smooth sailing as possible and you want to talk to people who are

transparent with you all the way.

One of the most reliable local real estate developers that has been around for

years is Lumina Homes. It’s a company that has been known for the quality of

its projects as well as affordability.

Lumina Homes currently has projects in Metro Manila as well as in Rizal,

Bulacan, Pampanga, Bataan, Zambales, Tarlac, La Union, Pangasinan, Nueva

Ecija, Cagayan, Isabela, Cavite, Batangas, Laguna, Quezon, Camarines Norte,

Albay, Sorsogon, Iloilo, Capiz, Cebu, Negros Occidental, Agusan del Norte,

Bukidnon, Zamboanga del Sur, Misamis Occidental, Davao del Norte, Davao del

Sur, and South Cotabato.

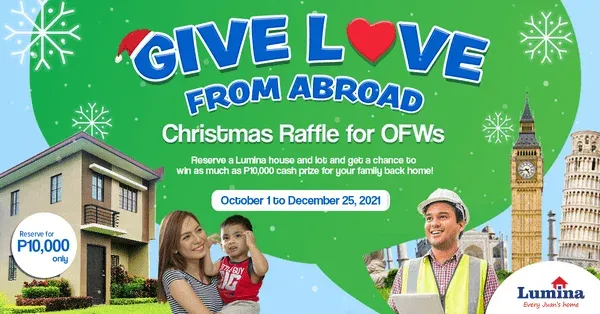

Lumina Homes also recently launched special Christmas giveaway promos for OFWs

as well as its agents.

Christmas is a big part of the Filipino culture and it has been our tradition

to celebrate it together. However, because of the current circumstances, many

Filipinos, especially the overseas Filipino workers (OFWs) have to celebrate

the holidays away from their loved ones.

Even before the pandemic though, OFWs have been known for their sacrifices

just to be able to give their families a bright future that’s why they are

dubbed modern heroes.

As a tribute to OFWs, Lumina Homes is currently running the

Give Love from Abroad Buyers’ Promo.

As Lumina unveils its Christmas theme Juan Love this Christmas, it also honors

hardworking OFWs who make sure their families have a comfortable home at all

times.

Thus,

Lumina Homes gives back the love

this holiday season with

Give Love from Abroad: Pamaskong Lumina Raffle Promo for OFWs. To

make the Christmas season more special, this raffle promo is open for buyers and referrers.

Earning raffle tickets is easy. The principal buyer OFWs will get three raffle

tickets for every Lumina Homes reservation from October 1 to

December 25, 2021. Buyers may get more raffle tickets by referring Lumina Homes to their

fellow OFWs. Each referral is entitled to one raffle ticket.

Winners receive the following prizes:

- First prize: P10,000

- Second prize: P5,000

- Third prize: P3,000 (third prize)

- Consolation prizes that include AllEasy load and Lumina freebies.

The live draw will be on Lumina’s official Facebook page on

December 27, 2021.

Meanwhile, Lumina Homes also launched its

LuminAguinaldo Sellers’ Promo for its agents. Lucky sellers get to take

home any of the following:

- Cash prizes

- Lechon

- LED TV

- A refrigerator

- Washing machine

- Tablets

- Cellphones

- Christmas baskets from AllHome

- A shopping spree for as much as P5,000

If you are a Lumina seller, you are entitled to raffle tickets for every

valid reservation from October 1 to December 28, 2021. The

number of raffle tickets will be based on the house model reserved by your

buyer. Also, your accounts should be updated upon redemption of the prizes.

Join the Lumina-wide Virtual Year-End Party on

December 29, 2021 to catch the announcement of winners of the

LuminAguinaldo raffle promo!

For the latest updates on Lumina Homes, contact (0917) 629 6523. Visit

www.lumina.com.ph

and/or like @luminahomesofficial on Facebook.

6. Choose between brand-new or second hand

A brand-new house is what most of us dream about. We want modern interiors,

manicured lawns, new paint, and so on. However, not all of us have the money

for it. The next best option will be to purchase a second-hand house.

There are second-hand houses that look well-maintained and very much

presentable. Some look dilapidated though and might require

renovations to a large extent and you might end up with a bigger cost as

compared to getting a new house.

7. Listing sites are your friends

One of the most useful tools to help us look for possible choices is property

listing sites. These sites feature filters like prices, number of bedrooms,

and locations to narrow down our choices. There are also pictures included in

the listing so we don’t have to go out right away just to view the properties.

8. Look at market indicators

Some of the market indicators that you have to keep an eye on are the prices

of commodities and home loan rates. These are the things that will eventually

dictate the purchasing power of money and your ability to pay off your loan,

in case you decide to get one. You also have to consider your job security,

especially in uncertain times like in a pandemic.

9. Talk to your bank

If you are not financially savvy, it’s always good to consult your bank. They

can offer you a housing loan that is tailored to your current ability to pay.

Your bank can give you a computation of your monthly amortization based on the

term of the loan and the amount that you are planning to borrow.

10. Ask for referrals

You can ask your friends or your colleagues to refer houses that are for sale

or if they know other people who are selling properties in a location where

you are interested to buy real estate.

11. It’s alright to postpone your plans

Even if you have carefully planned things out, some factors can get

in the way such as the pandemic.

We were targeting to get a house in 2020 but then the COVID-19 pandemic

happened which prevented us from checking the properties that we were hoping

to see. It’s perfectly fine to delay plans when things are not going our way.

Just keep in mind that things will eventually fall into place in the future.

Epilogue

We all dream of purchasing our dream home for our family. However, there are

still things to consider to make sure that things will proceed smoothly

especially because buying a house is a long-term commitment.

PIN THIS POST

Other similar stories:

This post may contain affiliate links, including those from Amazon Associates, which means that if you book or purchase anything through one of those links, we may earn a small commission but at no extra cost to you. All opinions are ours and we only promote products that we use.

Download a free copy of my Churches of Nueva Ecija eBook HERE!

Thank you for the tips po dadi iv very informative perfect lalo na sa mga may plan na bumilo ng bahay .

ReplyDeleteThis is very helpful to someone like me na aspiring homeowner. Thank you po for sharing.

ReplyDelete